This past weekend, Chinese authorities unveiled yet another round of fiscal stimulus, promising to aid local governments caught in debt and prop up the faltering property market. However, the vague nature of these policies—lacking in specifics—did little to lift market sentiment, despite Beijing’s assurances that everything is under control. This announcement, the latest in a long string of efforts to stabilize China’s struggling economy, seems unlikely to deliver the robust results investors and citizens are waiting for. The economic challenges facing China today require more than just fiscal infusions—they require a fundamental change in economic strategy, and possibly even political leadership.

While an unsourced article suggesting Beijing might issue up to 6 trillion yuan ($850 billion) in bonds over the next three years sparked some investor optimism, the reality is sobering. Even Goldman Sachs, which revised its GDP growth estimate upward in response to the potential bond issuance, still expects China to miss its 5% target for the year. Investors and market watchers, many of whom have been hoping for a stimulus package on the scale of the 2008-09 effort, which totaled $586 billion, are growing weary. Those stimulus measures, equivalent to 7% of China’s GDP at the time, were instrumental in helping China ride out the global financial crisis, but replicating them today—at around $1.2 trillion annually—seems unlikely under welfare-averse President Xi Jinping.

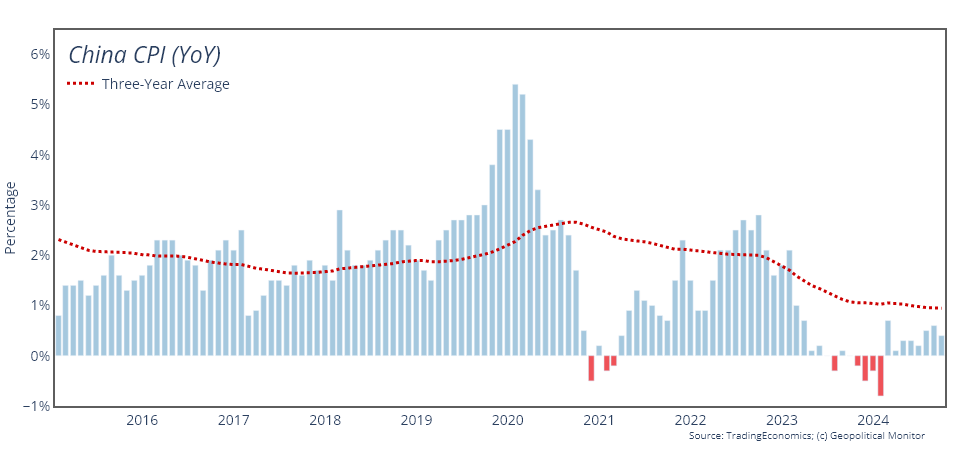

Even if Xi were to greenlight such an enormous fiscal package, the truth is that more money alone might not solve China’s deeper problems. Credit demand is shrinking, and China faces a more structural issue: stagnant household consumption. Despite repeated official pronouncements on the need for a consumption-driven economy, domestic demand remains stubbornly low. In fact, household consumption in China has long been below global averages, and recent data suggest it is barely growing.

The backdrop to China’s current economic malaise is markedly different from the 2008 financial crisis. Back then, the Chinese public was largely insulated from the downturn, with GDP growth still surging at 9.6%, albeit down from 13% the year before. The government’s stimulus package at the time was aimed at keeping the momentum going, not jump-starting a moribund economy. But today, the mood is far darker. It’s as if the party that Beijing once effortlessly kept alive has fizzled out, leaving few takers for the government’s latest attempt to rekindle the spark.

Consumer confidence, a key indicator of economic sentiment, paints a bleak picture. In 2008, it dipped by just 12 points amid the financial crisis. Compare that to April 2022, when China’s strict COVID-19 lockdown in Shanghai sent consumer confidence plummeting by 45 points. That confidence has not rebounded since. The sharp drop in consumer confidence underscores the deeper malaise that no amount of fiscal stimulus can quickly repair.

It’s not just the economic challenges that have shaken public sentiment; it’s the shifting perceptions of the Chinese government’s competence and future vision. In the early months of 2022, despite the economic turbulence caused by the pandemic, Chinese consumer confidence was high. Citizens believed that China’s stringent zero-COVID policy had succeeded where other nations had failed. But the continued lockdowns, followed by the abrupt abandonment of the zero-COVID strategy and a subsequent wave of deaths, have led to a crisis of faith in both the economy and the government.

This loss of confidence extends beyond short-term economic frustrations—it may also reflect growing disillusionment with the country’s political leadership. While it is nearly impossible to measure public sentiment toward President Xi Jinping and the Communist Party directly, the drop in consumer confidence suggests a broader loss of faith in China’s leadership. Even more telling is China’s plunging fertility rate, which fell from 1.5 children per woman in 2019 to just 1.0 by 2023. A low fertility rate is often a strong indicator that people are pessimistic about their future prospects. It is a sign that Chinese citizens are not just losing confidence in the present but are also questioning the long-term viability of China’s growth model and political stability.

As China’s economic machine sputters, the government seems increasingly unsure of its next steps. Stimulus measures alone, no matter how large, will not suffice to rebuild trust or spur growth. In a system where political stability is intertwined with economic performance, this disillusionment could have serious consequences. Perhaps what China needs now is not just a new economic approach but also a new political vision—one that addresses the growing gulf between the government’s rhetoric and the lived reality of its citizens.

Without this, Beijing’s efforts to inject money into the system will continue to fall flat. The underlying problem isn’t just economic stagnation—it’s the erosion of public confidence in China’s future. And that’s something no stimulus package can fix.