When the federal government holds $1.6 trillion in student loans owed by roughly 45 million Americans, any discussion about what to do with that debt is not just a policy conversation — it’s a statement about national priorities. Reports that officials in the Trump administration are exploring options to sell portions of the federal student loan portfolio to private investors reveal a familiar playbook: privatize the profits, socialize the risks, and call it reform.

According to people familiar with the discussions, senior officials at the Education and Treasury Departments have been quietly meeting with finance industry executives to gauge interest in acquiring high-performing segments of the government’s student debt. The goal, insiders say, is to shrink the federal balance sheet and let the private sector take on a larger role in student lending. On paper, that may sound like prudent fiscal management. In practice, it could prove disastrous — for taxpayers, borrowers, and the public trust.

A Return to Pre-2010 Thinking

To understand what’s at stake, it’s worth recalling that before 2010, private banks issued most federal student loans, while the government guaranteed them against default. The result was a system that enriched lenders while exposing taxpayers to enormous losses. Congress ended that arrangement when President Obama signed a law shifting all new loans to direct federal lending, saving taxpayers an estimated $60 billion over a decade.

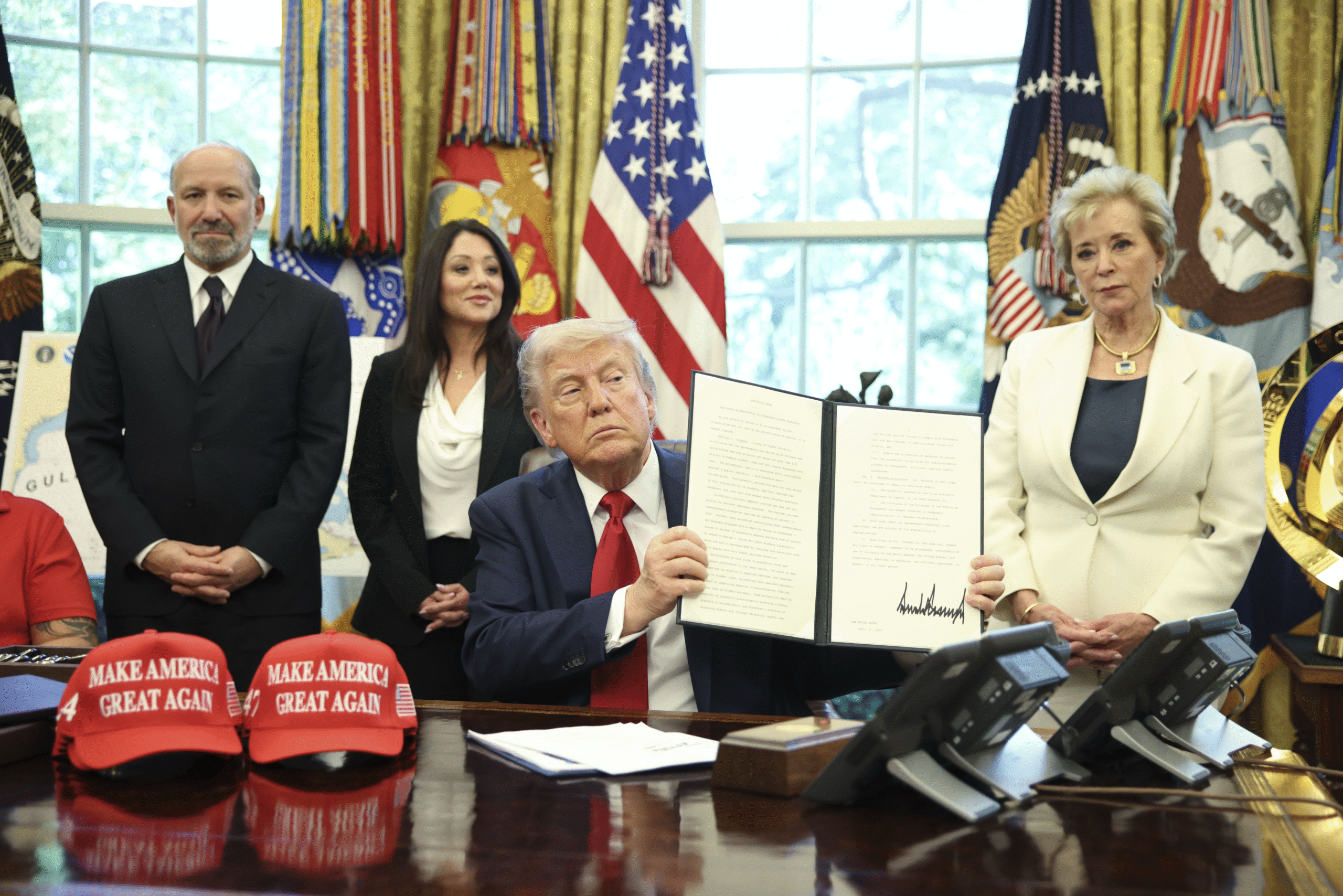

Now, more than a decade later, Trump officials seem poised to unwind that progress, effectively re-opening the door to Wall Street’s involvement in an arena that had been deliberately reclaimed for the public good.

The stated rationale is to “ensure the long-term health of the portfolio for both students and taxpayers.” But that framing obscures the core issue: federal student loans aren’t like commercial assets. They exist as a social contract — a promise that higher education should be accessible, even to those without wealth. Turning that promise into a financial product for investors undermines the moral foundation of the system itself.

A Bad Deal for Taxpayers

Selling off federal loans may make the government’s balance sheet look leaner, but it’s a fiscal illusion. Previous analyses — including one conducted during Trump’s first term — found that the student loan portfolio’s market value was far below its book value, meaning any sale would almost certainly occur at a loss. The federal government would collect pennies on the dollar for assets that, over time, generate steady repayments.

Economists like Preston Cooper of the American Enterprise Institute, typically friendly to market-based reforms, have called the idea “dubious.” As Cooper notes, private investors won’t pay full price for these loans, given uncertainty about repayment rates and political interference. “I really don’t see a scenario here where taxpayers come out ahead,” he said. “The most likely scenario is that taxpayers get less than the loans are actually worth.”

Put simply: the government would be selling low, buying political optics at the expense of financial prudence.

A Worse Deal for Borrowers

The more troubling impact, however, would fall on borrowers. Federal student loans come with protections unavailable in the private market — income-driven repayment plans, deferment and forbearance options, public service forgiveness, and flexible payment terms. If loans are sold to private entities, these protections could be diluted or lost altogether, even if officials promise otherwise.

Eileen Connor, who leads the Project on Predatory Student Lending, warns that privatization could only “make economic sense” if structured in a way that “short-changes borrowers.” Much of the government’s leverage — from wage garnishment to tax refund seizures — cannot be transferred to private hands. That means investors would demand steeper repayment terms to compensate for weaker collection powers. Borrowers, already squeezed by inflation and stagnant wages, could see higher costs, fewer safety nets, and harsher treatment from loan servicers.

In short, what Washington frames as fiscal responsibility could feel to millions of Americans like a financial ambush.

Ideology Disguised as Reform

The push to sell student loans is not just a technocratic exercise; it’s an ideological project. It fits neatly into the Trump administration’s broader effort to shrink the federal role in education — from rolling back Biden-era forgiveness initiatives to restarting collections on defaulted debt suspended during the pandemic. Trump has even pledged to close the Department of Education altogether, transferring some responsibilities to the Treasury or the states. Selling loans would advance that agenda by hollowing out one of the department’s core functions.

This isn’t reform — it’s retreat. It reflects a vision of government that views public service as inefficiency and private profit as efficiency. But student loans are not a widget business. They are a policy instrument intended to expand opportunity, not maximize returns.

The Bigger Picture: A Moral Reckoning

America’s $1.6 trillion student debt crisis is a symptom of deeper dysfunction — the soaring cost of higher education, stagnant public investment, and the shifting of economic risk onto individuals. The federal loan system, for all its flaws, at least anchors repayment within a public framework where policy can be guided by compassion, fairness, and equity. Handing that framework over to investors transforms it into yet another marketplace transaction.

If the Trump administration truly wants to “ensure the long-term health” of the student loan portfolio, it could start by strengthening borrower protections, improving loan servicing, and addressing the structural reasons students borrow so much in the first place. Selling debt to Wall Street won’t solve any of those problems — it will only conceal them behind an accounting trick.

A Test of Values

Ultimately, this debate is not about balance sheets. It’s about what kind of nation we want to be. Do we believe education is a public good or a private commodity? Do we view debt relief as a handout or as a recognition that the promise of opportunity should not become a lifelong burden?

Selling off student loans might lighten the government’s books for a fiscal quarter, but it would darken the future of millions of borrowers for a generation. In the end, the true debt we risk incurring is not financial — it’s moral.