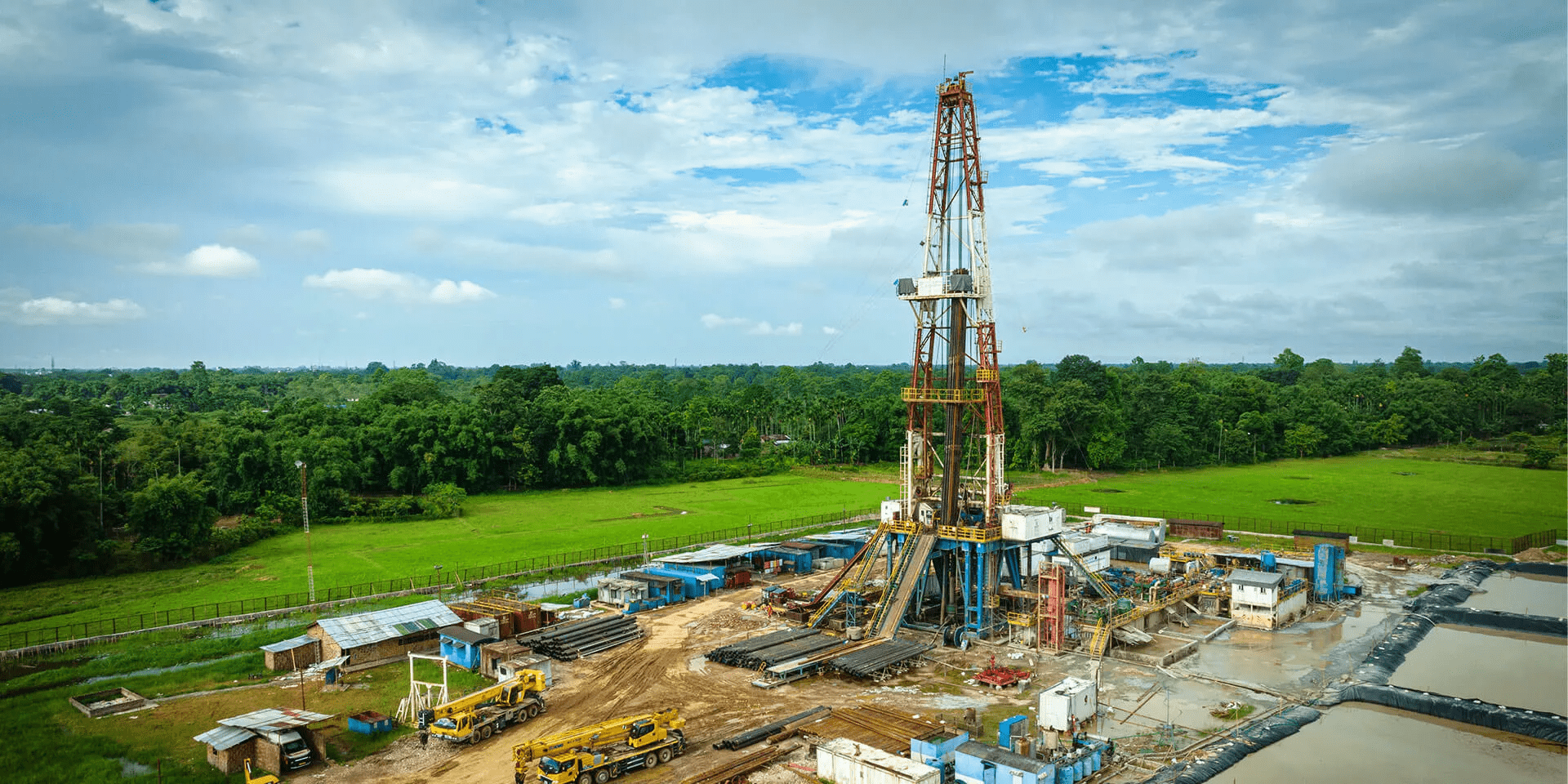

The Indian Oilfields Regulation and Development Act (ORDA), originally framed in 1948, was overdue for a serious overhaul. In a historic move, India recently passed groundbreaking amendments to ORDA, marking a pivotal moment in the country’s energy landscape and positioning it to become a major player in the global energy market. This legislative transformation promises not just economic growth and energy security for India, but also presents significant opportunities for global investors, reshaping the international energy narrative.

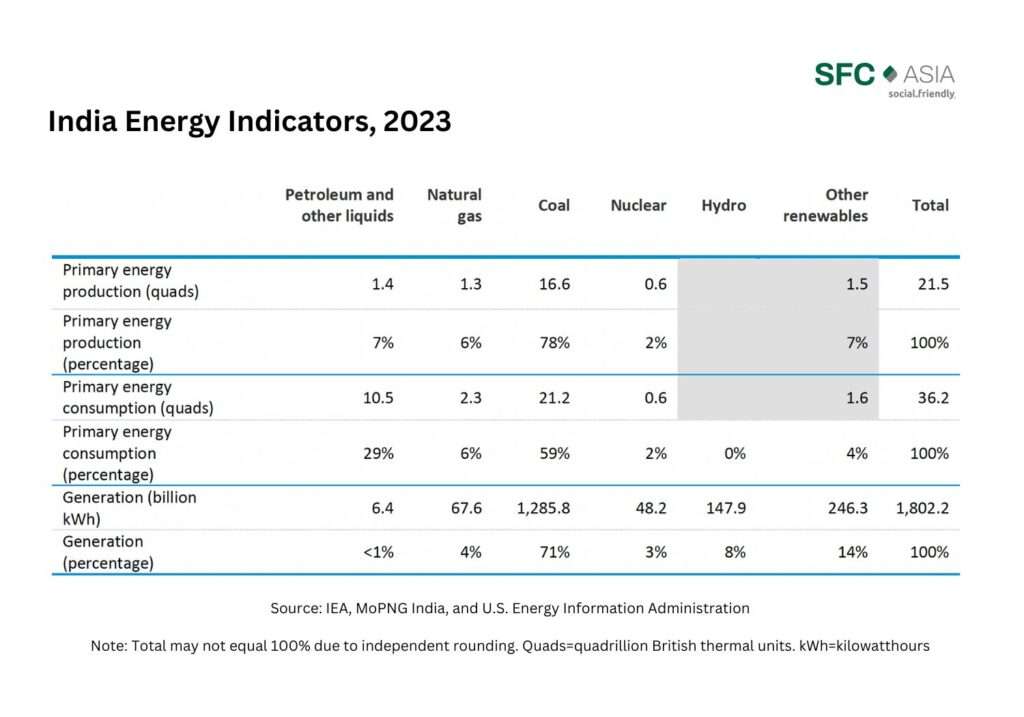

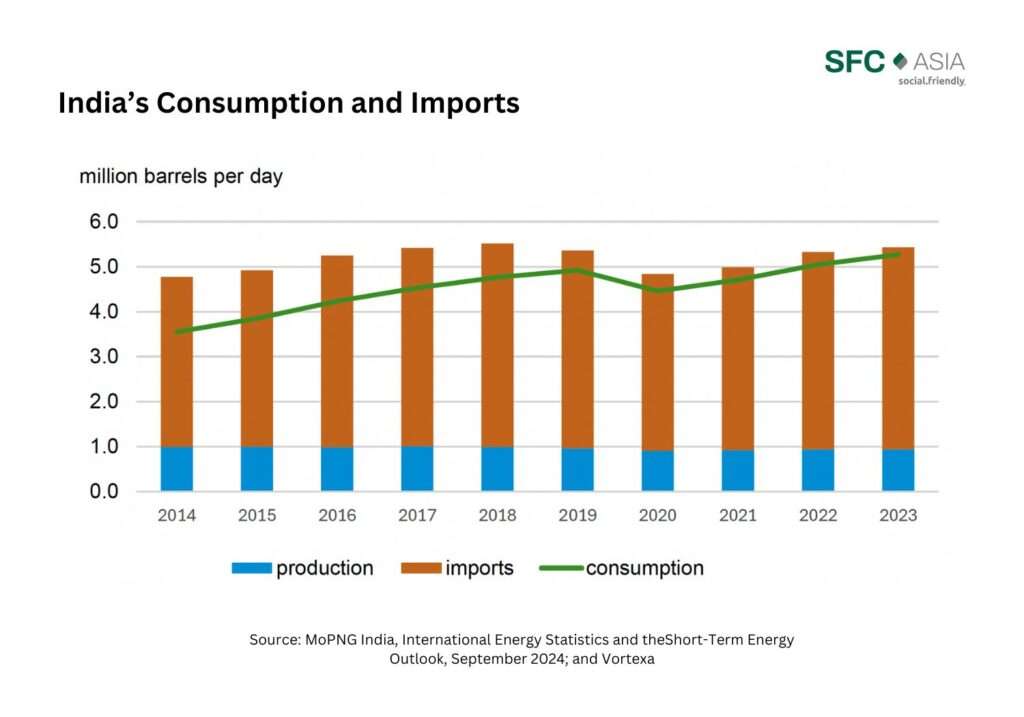

First, consider the scale of the challenge India faces. Currently, over 85% of India’s crude oil requirements are imported, creating significant vulnerabilities to international market fluctuations and geopolitical tensions. Moreover, approximately 70% of India’s domestic oil reserves remain untapped, highlighting a staggering opportunity awaiting exploitation. The amendments to ORDA address this opportunity head-on, signaling to global markets that India is open for business.

Central to these amendments is a modernization of regulations, aligning India’s energy sector more closely with global best practices. Historically plagued by bureaucratic delays, excessive paperwork, and a complex array of licenses, India’s oil and gas industry has often deterred foreign investors. The new act replaces the outdated licensing system with a simplified, unified petroleum lease. This single-lease mechanism reduces compliance costs and bureaucracy significantly, anticipated to slash the time required for obtaining regulatory approvals by 30-40%. Such streamlining is poised to catapult India higher in the World Bank’s Ease of Doing Business rankings, where it aims to break into the top 50 countries, a marked improvement from its 63rd position in 2020.

Moreover, the act’s expanded scope is transformative, encompassing not only traditional hydrocarbons like crude oil and natural gas but also unconventional resources such as shale gas and coal-bed methane. This diversification aligns India’s resource policy with global trends, expanding opportunities for foreign technology providers and energy companies specializing in advanced extraction techniques. Already, global giants such as ExxonMobil, BP, Chevron, and Petrobras are eyeing opportunities that the newly liberalized market presents.

Policy stability, another cornerstone of the amendments, introduces extended lease periods and structured dispute resolution mechanisms, including alternative dispute resolution (ADR) and international arbitration. This provision alone significantly enhances India’s attractiveness to foreign investors by offering predictability and reducing litigation-related uncertainties. With clearer regulations and improved legal frameworks, international firms are likely to commit substantial, long-term capital to India’s exploration and production (E&P) sector.

| Company | Ownership (%) as of FY24 | Total Income from Operations in FY23 (US$ billion) |

| Indian Oil Corporation Limited | 51.50% state-owned | 106.37 |

| Reliance Industries | Public Listed | 119.9 |

| Bharat Petroleum Corporation Limited | 52.98% state-owned | 61.2 |

| Hindustan Petroleum Corporation Limited | 54.9% state-owned (through ONGC) | 55.76 |

| ONGC | 58.89% state-owned | 19.75 |

| GAIL India Limited | 51.90% state-owned | 16.16 |

| Oil India Limited | 56.66% state-owned | 4.52 |

Financial deterrence, replacing previously stringent criminal penalties with monetary fines for non-compliance, has attracted debate but is undeniably business-friendly. Critics rightly point out potential environmental concerns, but proponents argue that this shift aligns with international norms, focusing more on financial accountability and reducing the fear of disproportionate criminal prosecution, a significant deterrent to foreign investors.

India’s rapidly growing energy sector takes a historic step into the future with the landmark amendments to Oilfields (Regulation and Development) Act 1948 being successfully passed in Rajya Sabha today.

— Hardeep Singh Puri (@HardeepSPuri) December 3, 2024

The epochal amendments proposed will further strengthen and propel India’s… pic.twitter.com/PaB5627Pg3

The amendments are more than just financial incentives; they represent a strategic shift towards India’s long-term vision of energy self-reliance—“Aatmanirbhar Bharat.” By enhancing domestic production capacities and reducing import dependence, India not only strengthens its economy but also mitigates geopolitical risks associated with reliance on oil imports from volatile regions.

But what makes the ORDA amendments genuinely future-oriented are the built-in incentives for sustainability. The act explicitly supports the development of green energy technologies, including hydrogen production and carbon capture. By aligning its hydrocarbon production with global decarbonization goals, India positions itself as an attractive destination for ESG-focused investors and technology providers. It directly complements India’s ambitious target of achieving 500 gigawatts of renewable energy capacity by 2030 and producing 5 million metric tonnes of green hydrogen annually.

Of course, challenges remain. State versus central government jurisdictional tensions, especially regarding revenue-sharing models, must be handled carefully to ensure cooperative federalism. Balancing the interests of powerful state-owned enterprises like ONGC with new private-sector entrants will require adept policy management and diplomatic finesse.

Nevertheless, the global investment community sees enormous potential. Advanced technological transfers are expected to boost India’s operational efficiencies, setting off a virtuous cycle of investment, innovation, and increased productivity. As international firms bring cutting-edge exploration and extraction technologies, India will witness substantial productivity gains in previously unviable marginal fields.

The ORDA amendments aren’t just reform—they represent a strategic recalibration of India’s role on the global energy stage

In terms of raw economics, the ORDA amendments are projected to increase foreign direct investment (FDI) in India’s energy sector by 15-20% within the next three to five years. The resulting revenue growth from royalties and taxes will significantly bolster India’s economic stability. Simultaneously, reduced import dependency will shore up the country’s balance of payments, offering more resilience against global energy price volatility.

To delve deeper into the far-reaching implications of the ORD Act 2024, the Society for Petroleum Professionals, in collaboration with SFC Asia and Social Friendly, will host a high-powered workshop in May 2025. This workshop will bring together industry leaders, policymakers, and sustainability experts to chart a path forward, ensuring India’s energy reforms translate effectively into international opportunities.

As the world grapples with shifting geopolitics, volatile oil prices, and the imperative of sustainable energy, India’s ORDA amendments signify more than just domestic regulatory improvements—they represent a strategic pivot in global energy policy. For international energy companies and investors, India now presents a compelling narrative: a massive, growing economy with vast untapped resources, streamlined regulations, and robust legal safeguards.

By streamlining regulation and embracing innovation, India is sending a clear message to global investors: our energy future is open for business

India’s bold leap forward through the ORD Act 2024 is not just an internal policy shift; it marks India’s arrival as a significant influencer in global energy markets. If executed effectively, the ORDA amendments will cement India’s position as a central hub for global energy investments, transforming regional dynamics and setting a powerful example for emerging markets worldwide.

For global markets, India’s energy transformation under ORDA is a critical development, and the world should take note. The future of energy security and sustainability may well be reshaped by how effectively India harnesses the potential unlocked by these amendments. The stakes are global, and the opportunities unprecedented.