In the ever-shifting landscape of American trade policy, the term “strategic” has become the magic word for making tough economic choices more palatable. Whether in the White House or on Capitol Hill, policymakers have learned that labeling a product or industry as “strategic” is often the quickest way to justify tariffs, restrictions, or subsidies in the name of national security. But as the latest tariff proposals demonstrate, deciding what counts as “strategic” — and what to do about it — is proving to be far more complicated than expected.

Nowhere is this tension clearer than in the approaches taken by President Donald Trump, his advisors, and Congress. Last month, some of Trump’s aides floated the idea of imposing tariffs on all trading partners — but only on a select group of goods deemed critical to defense, medical supplies, and energy. That plan was swiftly dismissed by Trump himself as “fake news.”

Congress, however, is taking a more targeted and openly confrontational stance, particularly toward China. A bipartisan duo — Representatives John Moolenaar, a Michigan Republican, and Tom Suozzi, a Democrat from New York — have introduced the Restoring Trade Fairness Act. Their proposal calls for a sweeping 35 percent tariff on all non-strategic Chinese goods, and a steep 100 percent tariff on imports classified as strategic.

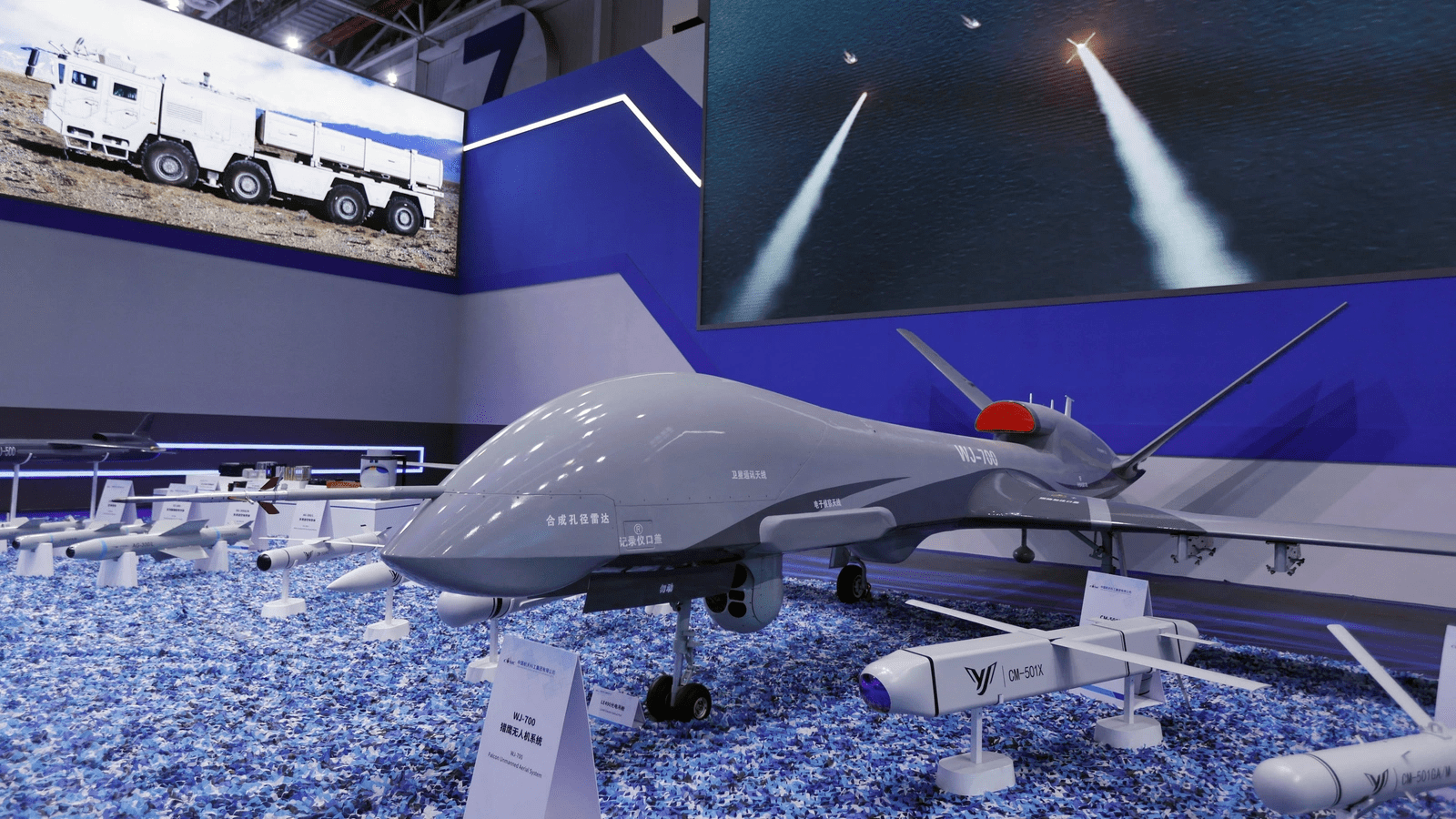

What makes their plan stand out is its specificity. Rather than leaving the definition of “strategic” vague, Moolenaar and Suozzi build directly on the Biden administration’s list of advanced technologies and China’s own Made in China 2025 goals. The result is a strategic goods list heavy with high-tech products — from semiconductors and industrial robots to military equipment and radioactive materials. If enacted, their 100 percent tariff would apply to around $200 billion worth of Chinese imports — nearly half the total value of U.S. goods purchased from China.

However, a closer look at the list reveals a few head-scratchers. Among the items deemed strategic: lawnmowers. While lawn equipment can be dangerous in the wrong hands, it’s hard to imagine America’s national security hinging on perfectly trimmed grass. The inclusion of lawnmowers, it turns out, is because agricultural machinery is a Made in China 2025 priority — raising a deeper question about whether every sector China cares about should automatically become a U.S. strategic interest. By adopting this approach, Washington risks allowing Beijing to set America’s economic agenda instead of charting its own path based on U.S. strengths.

That’s not to say all strategic goods are obvious. Some critical imports, like ship-to-shore cranes, might not capture public attention but play a vital role in keeping ports running. In fact, nearly 80 percent of these cranes come from one Chinese state-owned enterprise, ZPMC. This vulnerability was recognized by the Biden administration, which included the cranes in its own round of tariffs last year — a comparatively modest package targeting $18 billion in Chinese imports, far smaller than what Moolenaar and Suozzi propose.

Beyond the goods themselves, there’s a larger debate over the purpose of tariffs and what they’re meant to protect. Are tariffs supposed to secure supply chains for essential industries? Preserve American jobs in vulnerable sectors? Or simply punish China for unfair trade practices? In the case of lawnmowers, some might argue that protecting their production helps sustain broader manufacturing capacity that supports farm equipment essential to food production. Yet American farm machinery companies have repeatedly warned that tariffs could backfire by raising costs, disrupting supply chains, and inviting Chinese retaliation — which is exactly what happened when Beijing slapped its own tariffs on U.S. farm equipment.

This highlights a critical — and often overlooked — question: Once a product is labeled strategic, what’s the best way to ensure reliable supply? Tariffs are one option, but they are rarely the most effective. True resilience requires mapping supply chains, investing in domestic production, partnering with trusted allies, and crafting incentives for innovation. The cost and complexity of securing supply vary enormously from one product to another — and for many goods, smart partnerships may be a better solution than blunt tariffs.

But tariffs remain Donald Trump’s weapon of choice. His interpretation of “strategic goods” appears to cover nearly everything, including cars, lumber, and even digital services taxes imposed by U.S. allies. His administration argues that tariffs can be a valuable tool for strengthening economic security, pointing to past steel and aluminum tariffs justified on national security grounds.

The bigger the strategic goods list becomes, the harder it is to design a coherent strategy to match. Like a chef adding seasoning to a dish, a sprinkle of “strategic” can enhance trade policy — but too much quickly overwhelms the entire recipe. As Washington continues to redefine America’s economic priorities, policymakers may need to relearn an old truth: when everything is strategic, nothing is.