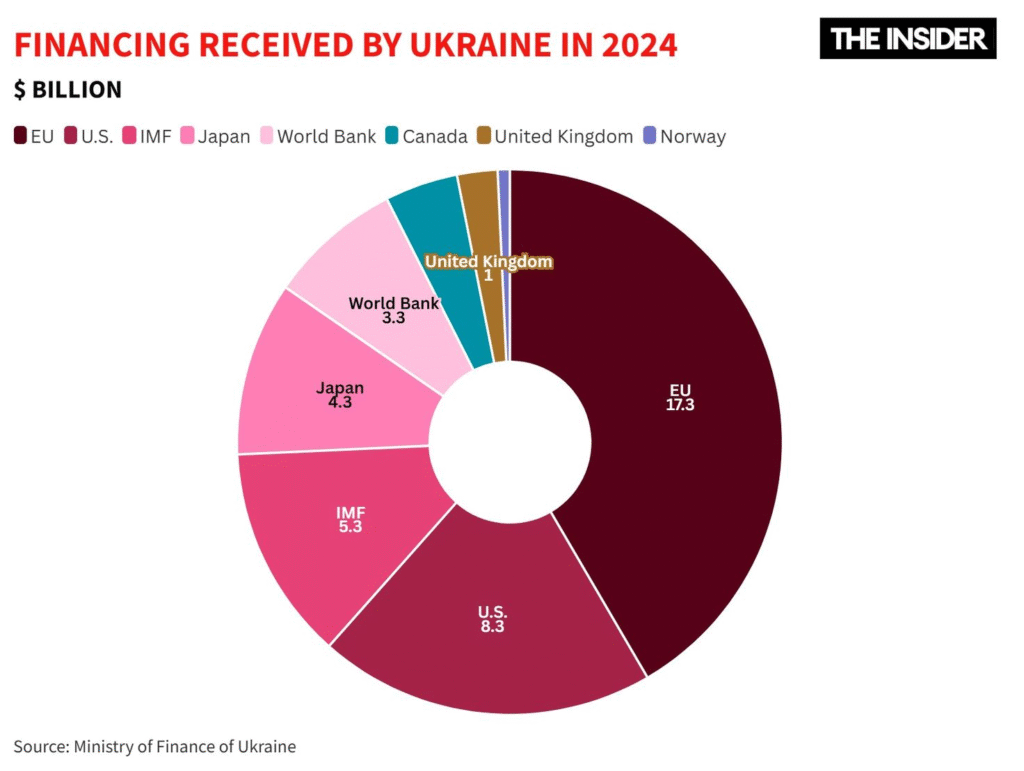

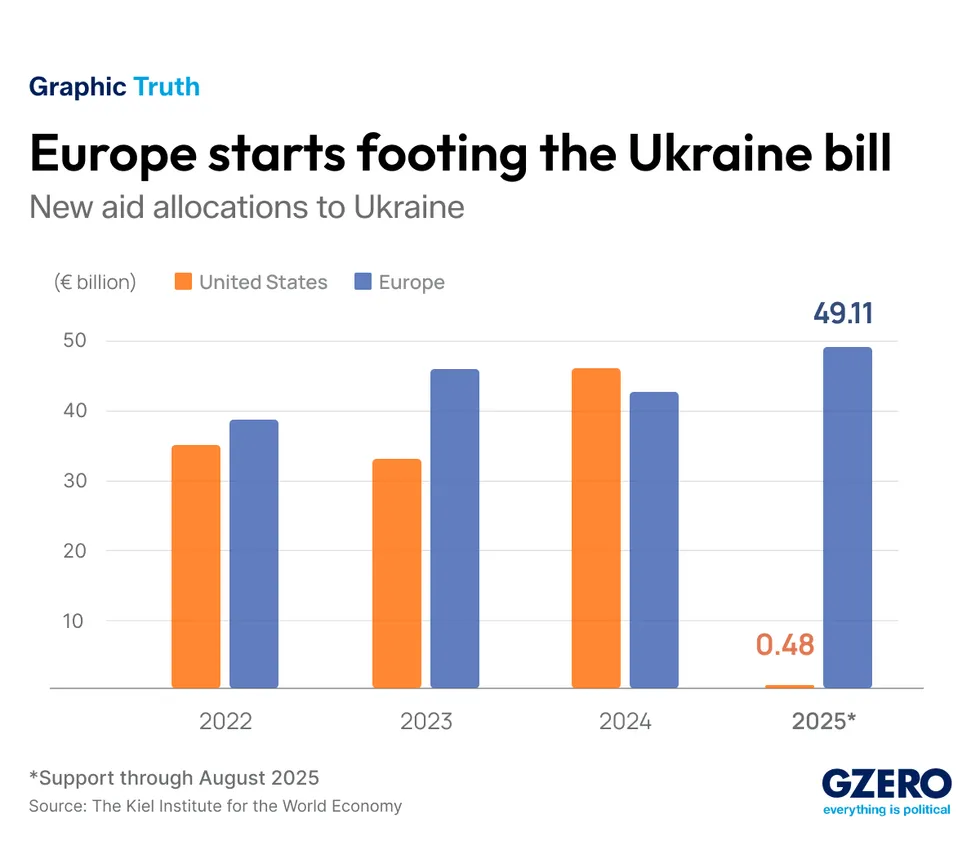

As Ukraine edges toward a potentially catastrophic funding shortfall early next year, the European Union faces a familiar dilemma: the collision between geopolitical necessity and internal political fragmentation. What should have been a unified show of resolve — transforming Russia’s frozen assets into a powerful financial lever for Kyiv — has instead morphed into a case study in European caution, legal anxiety, and the slow mechanics of consensus politics.

At stake is not merely a financing mechanism, but the credibility of Europe’s strategic autonomy and its ability to sustain Ukraine through the most perilous phase of the war to date. The debate over a €140 billion “reparations loan” funded by immobilized Russian reserves has now become a test of whether the EU can act decisively when its own security architecture is on the line — or whether it will outsource urgency to stopgap measures and political improvisation.

The Frozen Assets Paradox

The reparations loan plan is, in theory, elegantly ruthless: Russia’s assets fund Ukraine’s survival, repayable only if Moscow someday accepts liability for war damages — a scenario most EU officials privately concede borders on fantasy. Yet it is precisely this legal and moral maneuvering that has triggered fierce resistance from Belgium, where the assets are held. Prime Minister Bart De Wever’s concerns about legal exposure and Russian retaliation may be prudent from a narrow national perspective, but they expose a structural vulnerability: a single member state can paralyze a continental response.

This veto power illustrates a recurring flaw in EU governance. While Brussels speaks in the vocabulary of strategic unity, real power fractures at the points of domestic political risk. De Wever is not simply blocking a loan; he represents the fear that Europe may set a precedent with consequences extending beyond the Ukrainian battlefield into the foundations of international finance itself.

Bridging Loans: A Symptom, Not a Solution

Enter Plan B: a bridging loan, financed through joint EU borrowing, designed to buy time and keep Ukraine solvent into early 2026. Framed as temporary, this mechanism is widely seen as the only viable fallback should the reparations loan stall. But calling it a “bridge” obscures the uncomfortable truth — Europe is building financial scaffolding around indecision.

The politics are treacherous. Joint borrowing evokes memories of eurobonds and pandemic-era fiscal battles, and once again unanimity looms as the hurdle. Hungary’s predictable opposition could derail the entire mechanism, unless creative semantic gymnastics rebrand the loan as reconstruction support rather than war funding.

This rhetorical acrobatics reveals more than policy nuance; it exposes a political anxiety about the optics of solidarity. Europe feels compelled to help Ukraine, but uncomfortable acknowledging the full implications of that commitment to its own voters.

Trump, Peace Talks, and Leverage Politics

Complicating the picture is the renewed momentum around peace negotiations and Donald Trump’s reassertion as a geopolitical actor. European officials hope Trump’s push for talks might paradoxically galvanize support for using Russian assets — but it also introduces uncertainty. Draft peace proposals suggesting U.S. profits from frozen assets alarmed Brussels, reigniting fears that Europe could lose control over its own sanctions regime and strategic leverage.

The deeper anxiety is not just financial — it is about sovereignty. Who decides the fate of Russian assets? Who controls the tempo of sanctions relief? And who shapes Ukraine’s path toward EU membership? These questions strike at the heart of Europe’s vision of itself as a power bloc, not merely a donor consortium.

The Cost of Delay

Time is the unforgiving variable. Kyiv has warned of running out of money within months. Every delay narrows Europe’s strategic options and increases Ukraine’s vulnerability at the bargaining table. The longer Brussels debates legal finesse and political optics, the more leverage shifts away from Ukraine and toward those who prefer a negotiated settlement on Moscow’s terms.

The rhetoric from leaders like Emmanuel Macron — promising imminent solutions and “visibility” for Ukraine — cannot mask the structural reality: Europe is reacting, not leading.

A Moment That Demands Resolve

In the long term, the reparations loan remains, as diplomats admit, “the only game in town.” Yet the EU’s reluctance to act decisively on it reflects a deeper crisis of confidence. If Europe cannot marshal the political courage to deploy frozen aggressor assets to defend a nation fighting for its sovereignty, what does its commitment to international law and democratic solidarity truly mean?

The choice should not be framed as legal risk versus fiscal prudence. It is, fundamentally, a choice between strategic clarity and managed decay. Bridging loans can postpone collapse, but they cannot substitute for vision.

Europe must decide whether it wants to be remembered as a hesitant accountant of crisis — or as a geopolitical actor willing to redefine the rules when history demands it.