Prez Donald Trump’s present stance on India, marked by tariff hikes and calls for reducing reliance on Indian labor and imports, appears increasingly misaligned with the evolving economic realities and potential of one of the world’s fastest-growing large economies. Recent data reveals why this position is strategically flawed and economically counterproductive.

India’s domestic economy grew at a robust 7.8% in the first quarter of the fiscal year 2025-26, exceeding estimates and demonstrating resilience despite external pressures such as the 50% tariffs imposed by the U.S. This growth rate surpasses the Reserve Bank of India’s forecast of 6.5% and outpaces growth for the same quarter last year at 6.5%. The surge is driven predominantly by vibrant activity in services (9.3% growth), manufacturing (7.7%), and construction (7.6%), reflecting broad-based economic momentum. This growth challenges the notion of India’s economy being “dead” or weak as suggested by Trump, instead indicating a dynamic internal economy with considerable expansion potential. Even with punitive tariffs aimed at curbing imports from India, the economy has posted a five-quarter high growth rate, signaling robust underlying strength beyond external trade conflicts.

India’s economic story diverges from typical export-driven models seen in other emerging markets, as roughly 68% of its GDP is fueled by domestic consumption including household and government spending. This domestic demand is buoyed by a steadily rising middle class with increasing discretionary income, driving growth in sectors such as consumer durables, retail, healthcare, telecom, and entertainment. Rather than relying heavily on export markets or manufacturing exports, India’s economy is primarily consumption-led, demonstrating resilience amid global trade disruptions. This internal demand acts as a cushion against external shocks like tariffs, making India comparatively less vulnerable to trade tensions than economies focused on exports. This nuance is critical, as targeting India through tariffs risks misunderstandings about how the country’s economy actually functions.

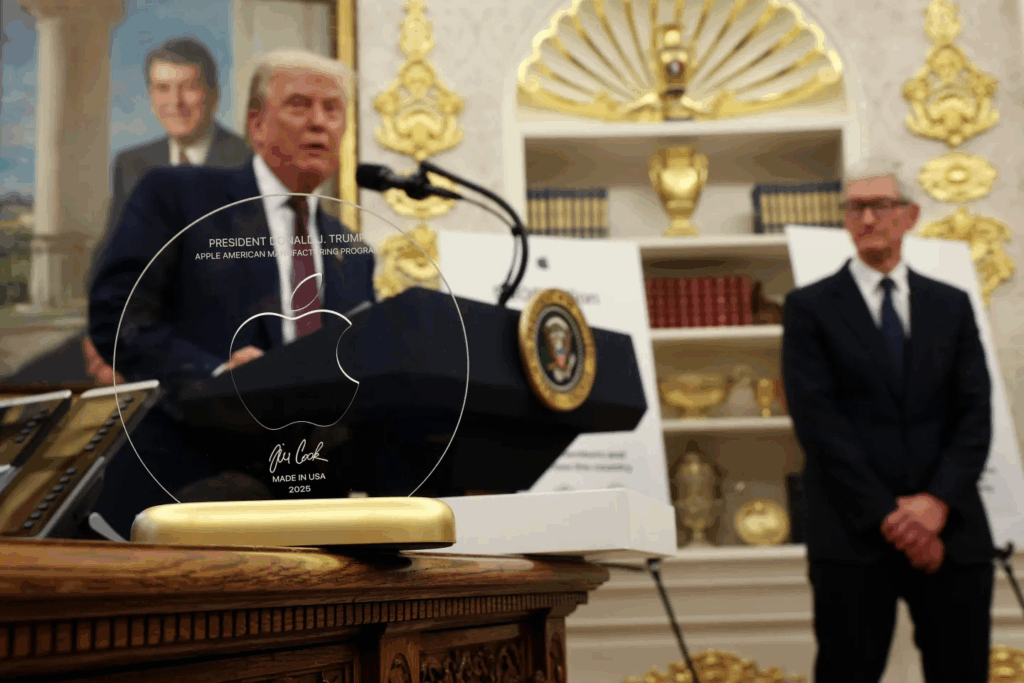

Despite Donald Trump’s calls for U.S. companies to reduce ties with India and “make in the U.S.,” Apple’s actions reflect a starkly different approach. In 2025, Apple has significantly ramped up iPhone production in India, with manufacturing growing 53% year-over-year in the first half of the year. India now produces approximately 17% of the world’s iPhones, with projections to reach 25% by 2027.

Apple is investing approximately $2.5 billion in India to expand its iPhone production capabilities, aiming to raise output to around 60 million units annually from over 40 million currently. In addition, Apple’s main supplier Foxconn is investing $1.5 billion into its Indian operations to support this ramp-up in production.

This shift is part of Apple’s broader strategy to diversify its global supply chain away from China amid heightened U.S. tariffs and geopolitical uncertainties. Notably, Apple’s expansion involves high-value production, including newer models like the iPhone 16 Pro and potentially the entire iPhone 17 lineup. Such moves demonstrate strong corporate confidence in India’s manufacturing ecosystem, skill availability, and policy environment, countering Trump’s rhetoric about limiting Indian labor or influence in U.S. companies.

By imposing steep tariffs and adopting a punitive posture, the Trump administration risks damaging a strategically valuable relationship. India is not only an economic powerhouse but also a crucial geopolitical partner in maintaining a balance of power in the Indo-Pacific region. The tariffs threaten thousands of exporters and jobs in India, aggravating tensions and fostering mistrust. Instead of strengthening ties through dialogue and cooperation on trade and investment, the confrontational approach may push India closer to other global powers such as China or Russia. Moreover, reducing bilateral trade engagement could curtail U.S. access to a rapidly growing market and a partner that complements American economic and technological strengths. The long-term risks include diminished U.S. geopolitical leverage and missed economic opportunities in areas such as technology co-development, supply chain diversification, and services trade.

In essence, Trump’s policy on India appears disconnected from facts on the ground. India’s economy, powered by strong domestic consumption and robust growth, has proved resilient despite tariff pressures. Global companies like Apple are deepening manufacturing investments in India, reflecting confidence in its market and capabilities. Consequently, a coercive U.S. stance risks sidelining America from an increasingly influential partner with significant economic and strategic potential. The emerging economic realities suggest the need for policies that recognize India’s growth dynamics and position the U.S.-India partnership for mutual advantage, rather than perpetuating counterproductive discord.