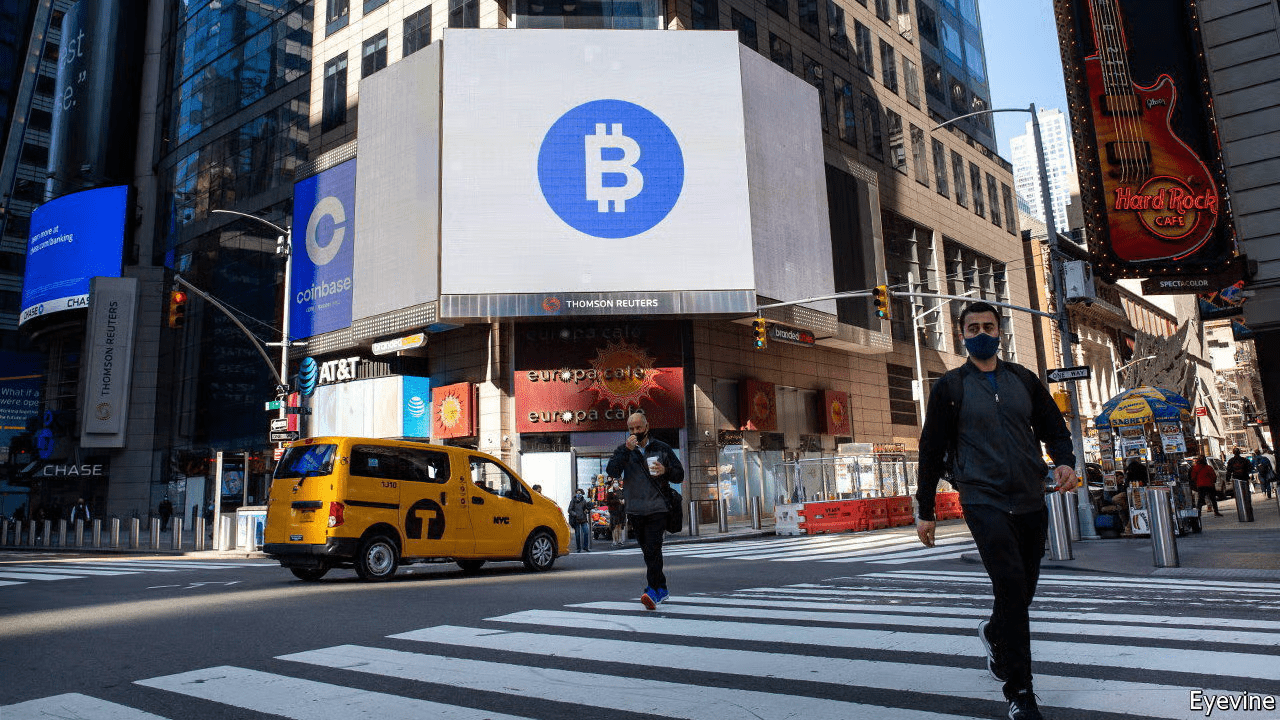

The stage is set for an unprecedented clash in the nation’s capital as cryptocurrency companies and traditional banking giants gear up for a fierce lobbying battle over the future of digital asset regulation. The fight, driven by Republican-led initiatives to expand the crypto market, is expected to peak when Congress reconvenes next month after its summer recess.

The crypto industry has enjoyed a string of legislative wins since President Donald Trump’s return to the White House, including the first major overhaul of digital asset rules in U.S. history. But as Republicans prepare to advance a sweeping second bill, Wall Street’s biggest players are sounding the alarm — warning that overly favorable crypto reforms could destabilize the financial system and drain deposits from banks.

“This is a turf war that’s been going on for years,” said Rep. Warren Davidson (R-Ohio), a longtime crypto advocate. “It’s only now, with the momentum behind us, that the resistance is coming into full view.”

Banking Sector Pushes Back

Concerns are particularly acute among smaller lenders, who fear losing customers to lightly regulated crypto products such as stablecoins — digital currencies pegged to the dollar. The recently enacted GENIUS Act, a landmark stablecoin law, has become a flashpoint. Bank trade groups are pressing Congress to revisit the legislation before the next crypto bill passes, seeking to curb stablecoin yields and roll back provisions they argue give state-chartered, uninsured institutions too much leeway to operate nationwide.

Christopher Williston, head of the Independent Bankers Association of Texas, described the law as “a fundamental threat to bank deposits” and likened it to “the thousand-and-first cut” to community banks already strained by years of regulatory pressure.

Crypto Industry Holds Its Ground

Digital asset advocates counter that the fight is settled. Summer Mersinger, CEO of the Blockchain Association, said the GENIUS Act emerged from months of negotiation and should not be reopened. “The way this bill came out was a compromise,” she said. “We shouldn’t go back and undo that.”

Crypto lobbyists are also active beyond Capitol Hill — pushing for national banking licenses, defending consumer data-sharing rules, and advocating for “tokenization” of U.S. stocks, a process they argue will modernize markets.

A Shift in Political Power

The growing rift reflects how Washington’s financial policy landscape has changed. Traditionally, banks and Republicans have marched in lockstep on deregulation. But the crypto sector’s aggressive political spending — hundreds of millions of dollars over recent election cycles — has made it a priority for the Trump administration and congressional GOP leaders.

Paige Pidano Paridon of the Bank Policy Institute insisted the debate is not about rivalry but fairness. “It’s about working together to create rules of the road that apply equally to everyone,” she said, warning that consumer trust and U.S. competitiveness are at stake.

Regulatory Flashpoints Ahead

Regulators are watching closely. At the Securities and Exchange Commission, Wall Street firms are urging caution on tokenized stocks, pressing for them to follow the same rules as conventional shares. Meanwhile, crypto and fintech executives recently persuaded the Consumer Financial Protection Bureau to rethink — rather than scrap — a Biden-era rule that bans banks from charging fees for access to customer financial data.

For now, the banking industry retains formidable influence in Washington. But the political tide, fueled by campaign donations and a growing alliance between crypto and conservative policymakers, is shifting fast. As the next round of legislation approaches, both sides are preparing for a high-stakes showdown that could reshape America’s financial system for decades.