In a world where trade disputes can flare into economic wars overnight, Washington and Brussels have just signed what might be best described as a cease-fire. The newly minted U.S.–EU tariff agreement—capping duties on European cars, pharmaceuticals, and semiconductors at 15 percent—has been hailed as a breakthrough. But make no mistake: this is not a peace treaty. It is an armistice, full of conditional clauses and mutual hedging, with enough built-in fragility to keep negotiators awake for years.

Averted Disaster, Not Achieved Harmony

The rhetoric from both sides is upbeat. EU Trade Commissioner Maroš Šefčovič called the agreement the product of “intense, essential work,” emphasizing that “this is not the end; it’s the beginning.” His words are telling—negotiators have avoided a head-on collision, but the vehicles are still speeding toward a curve in the road.

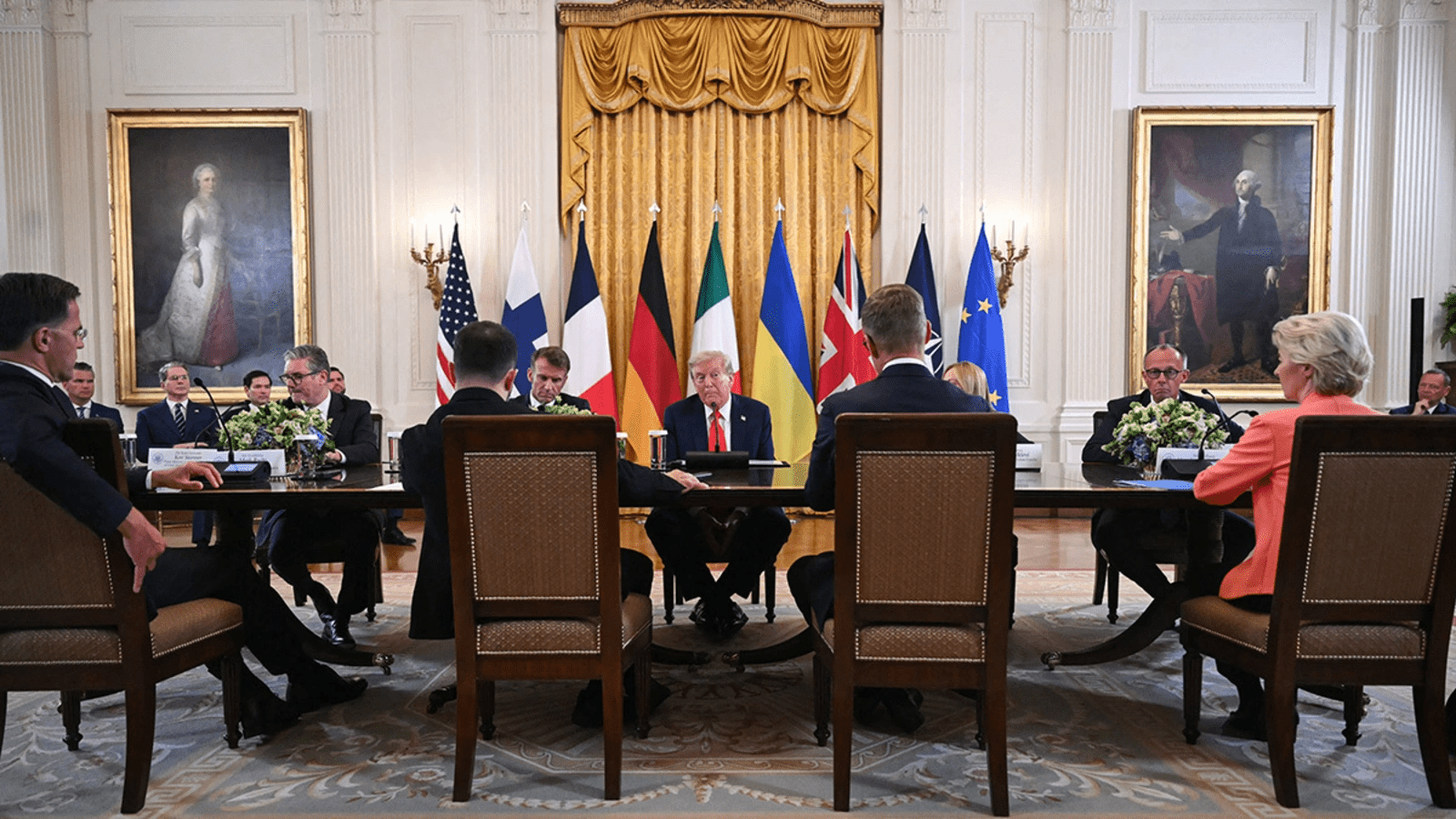

The deal emerged from a high-profile handshake between President Donald Trump and European Commission President Ursula von der Leyen at Trump’s Turnberry golf resort. That moment temporarily diffused Trump’s threat of blanket 30 percent tariffs on EU goods—a threat that could have ignited a full-blown transatlantic trade war. Yet, the agreement’s fine print is laced with dependencies.

Take autos, for instance: Washington’s pledge to slash tariffs on European cars from 27.5 to 15 percent comes with a catch—the EU must first legislate the elimination of all tariffs on U.S. industrial goods. That’s a politically sensitive move in Brussels, especially with domestic industries wary of losing protective barriers.

The Price of Cooperation

Beyond cars, the pact sketches out a quid-pro-quo landscape. The EU will expand market access for U.S. agricultural products deemed “non-sensitive,” while the U.S. will keep certain goods—like aircraft parts and generic drugs—safe from higher tariffs. Both sides also promise to tackle global steel and aluminum overproduction, a nod toward their shared competition with China.

Environmental and regulatory issues were not left untouched. Brussels will consider “flexibilities” in its carbon border tax for U.S. companies and ease the bite of sustainability reporting rules—clear concessions to American exporters who see EU climate policies as hidden trade barriers.

The energy and tech dimensions are striking. Europe will buy $750 billion worth of U.S. energy products through 2028 and at least $40 billion in American AI chips. European firms, in turn, are expected to pour $600 billion into strategic U.S. sectors. These are colossal sums, but they reflect mutual dependence rather than newfound trust.

The Geopolitical Subtext

What’s driving this deal is not simply a desire to avoid mutual economic harm—it’s the recognition of a more dangerous external reality. Both Washington and Brussels are facing rising economic assertiveness from Beijing and the challenge of securing critical supply chains. In this sense, the pact is as much a strategic alignment as a commercial compromise.

Yet, the road ahead is fraught. Legislative follow-through in both the U.S. and EU will test the agreement’s resilience. Protectionist lobbies on either side of the Atlantic could derail the best-laid plans. And the moment one party senses the other is shirking, the 15 percent cap could be history.

A Deal Worth Watching

Šefčovič is right to call this a “serious, strategic deal,” but it is also a reminder that global trade diplomacy is rarely about final victories. It’s about buying time—time to adjust, to prepare, and perhaps, to compromise again when the next crisis looms. This U.S.–EU accord may have prevented a transatlantic trade war for now, but its survival depends on political will, mutual restraint, and the recognition that economic interdependence is not a weakness to be exploited, but a reality to be managed.