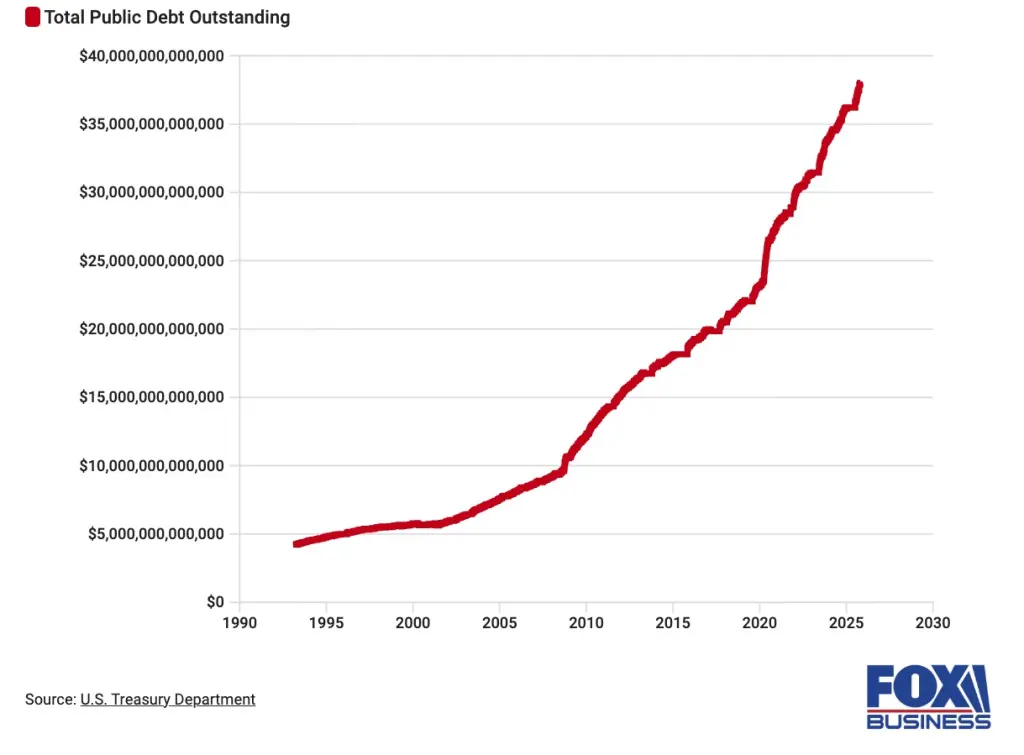

The U.S. has hit a historic and alarming national debt level of $38 trillion in 2025, marking a critical point with broad implications that could reshape global economic and geopolitical power dynamics. This massive debt, now over 320% of GDP with rapid growth in recent years, threatens the economic stability of the U.S. and carries serious consequences for its trading partners such as Mexico, Canada, China, Germany, and India. Analyzing the nature of this debt crisis and its likely global effects reveals profound risks and opportunities in international trade, currency dominance, and investment flows.

By late 2025, the U.S. national debt surged past $38 trillion, driven by large federal deficits, expansive government spending, and a government borrowing cost exceeding $1.2 trillion annually. The debt growth far outpaces economic growth, now standing at roughly 324% of GDP when federal government, corporate, financial, and household debts are combined. The Congressional Budget Office projects that without fiscal adjustments, deficits and debt ratios will continue to climb, potentially reaching levels unseen since World War II. The debt crunch pressures inflation, increases borrowing costs, and dampens Americans’ purchasing power, exacerbating socioeconomic inequalities.

The national debt just hit $38 trillion.

— Peter St Onge, Ph.D. (@profstonge) November 7, 2025

2 months after we crossed $37 trillion.

This comes to $287,000 in for every household in America — up $40,000 in the last year alone.

Congress is spending us into bankruptcy. pic.twitter.com/CnAayyCR9C

Ratings agencies have downgraded U.S. creditworthiness due to fiscal policy gridlock and unsustainable trajectories. This downgrade raises borrowing costs further and threatens the dollar’s long-term role as the global reserve currency. The uncertainty fuels a scramble for alternative safe assets like gold, which has surged significantly in value over 2025.

Implications for U.S. Global Power and Dollar Dominance

The debt crisis threatens the economic foundation of U.S. global power. As the U.S. struggles to contain its fiscal imbalances, the perceived stability of the dollar declines. A weaker dollar would raise inflation domestically and globally, simultaneously increasing the cost of imports and debt-servicing. Economists warn of a potential erosion of the dollar’s dominance if confidence weakens, possibly leading to a fragmented global currency system increasing volatility and costs for international transactions.

Without a single dominant power prepared to replace the U.S., there is a risk of fragmented global power structures, increasing the chance of financial crises with cascading impacts worldwide. How the U.S. addresses its debt will be crucial in determining the future balance of power.

Impact on U.S. Trading Partners

Mexico and Canada

Mexico and Canada, as the U.S.’s largest trading partners under the USMCA framework, face both risks and protected status amid tariffs and trade shifts. While earlier tariff regimes carved them out of certain punitive measures, ongoing fiscal uncertainty in the U.S. translates to increased borrowing costs and inflation that can disrupt trade flows.

The U.S. trade deficit with Mexico and Canada combined has recently surpassed the deficit with China, signaling growing economic interdependence though complicated by trade tensions. Rising U.S. debt and inflation could reduce American consumer purchasing power, affecting import demand from these neighbors. Additionally, tighter fiscal conditions in the U.S. may prompt shifts in bilateral investment and supply chains, as cost pressures impact manufacturing competitiveness.

China

China, previously the largest U.S. trade partner, now faces a recalibrated relationship as Mexico ascends in trade volumes. The debt crisis and potential dollar weakening could disrupt China’s dollar reserves and trade financing, forcing diversification into other currencies and assets such as gold and digital currencies.

However, China could face challenges if inflation and interest rate rises in the U.S. propagate globally, increasing the cost of their dollar-denominated debt and trade. Meanwhile, trade conflicts risk intensifying amid this fiscal uncertainty, with tariffs and geopolitical tensions compounding economic risks across both economies.

Germany

Germany, Europe’s largest economy and a key U.S. trading partner, may be impacted by shifts in U.S. fiscal policy and dollar stability. A weakening dollar generally benefits German exports by making them cheaper in global markets, but rising U.S. interest rates and inflation could dampen overall demand for German goods.

The Eurozone itself faces volatility risks if the U.S. debt crisis undermines confidence in the global financial system. Germany’s export-oriented economy depends heavily on stable transatlantic trade, which could be jeopardized amid growing fiscal uncertainties. Moreover, the global scramble for safer assets could redirect investment flows affecting German bond markets and economic outlook.

India

India stands at a pivotal juncture amid the U.S. $38 trillion debt crisis, benefiting from its gradual adoption of free-market reforms which align well with the evolving global order that favors open trade and minimal barriers over protectionism or heavy state intervention. India is building a strong foundation for sustainable economic growth through reforms aimed at expanding trade liberalization, accelerating privatization, and modernizing governance. With its projected 7-8 percent growth rate, India is not just impressing with its current performance but has the potential to amplify this trajectory significantly by deepening integration into the global economy.

Key ongoing efforts include securing comprehensive free trade agreements, such as the near-completion of negotiations with the EU, aimed at diversifying exports beyond services and reducing trade deficits. Simultaneously, India’s drive to digitize administrative processes helps curb bureaucratic delays, boosting overall economic output.

Moreover, India’s strategic use of its vast human capital and digital public infrastructure presents a transformative opportunity. Platforms like UPI, ONDC, Aadhaar, and DigiLocker showcase a replicable model of open, interoperable ecosystems that empower private fintechs and micro, small, and medium enterprises (MSMEs) to scale globally. Extending this openness to education systems—through market-based solutions such as portable learning credits and private accreditation—could revolutionize talent development and address skill shortages effectively. In contrast to the U.S., where regulatory burdens and burgeoning student debt have dulled innovation in education and research, India has a chance to invigorate its start-up ecosystem by ensuring intellectual property protections and reducing barriers to venture capital. Promising initiatives like semiconductor incentives in Gujarat and Tamil Nadu highlight the potential to evolve into a competitive technology hub with minimal state intervention, potentially rivaling Silicon Valley by the early 2030s.

Broader Global Financial and Geopolitical Effects

The U.S. debt crisis influences more than bilateral trade. It sets the stage for broader geopolitical shifts including:

- Inflationary pressures globally due to weaker dollar and costlier imports.

- Rising interest rates worldwide as debt-servicing becomes more expensive.

- Potential decline in U.S. financial market appeal, triggering capital redirection into emerging markets, gold, or alternative currencies.

- Heightened geopolitical tensions linked to economic struggles, tariffs, and trade conflicts involving major economies.

- A possible new multipolar economic order as the U.S. dollar’s hegemonic role is contested.

The U.S.’s $38 trillion debt crisis in 2025 is a watershed moment potentially reshaping global power and economic relations. For trading partners—Mexico, Canada, China, Germany, and India—the fallout includes trade disruptions, currency volatility, inflationary pressures, and shifting investment patterns. While the crisis poses significant risks of recessionary pressure and political instability in the U.S., it also opens pathways for global economic realignment and emerging market opportunities. How the U.S. manages this debt and its fiscal policies will be a decisive factor in future international economic stability and power balances.

References and Further Reading

- Fortune. (2025, October 21). As national debt accelerates to $38 trillion, watchdog warns of risks. Retrieved from https://fortune.com

- U.S. News. (2025, October 22). US hits $38 trillion in debt, after the fastest accumulation ever. Retrieved from https://usnews.com

- The Conversation. (2025, April 11). The rise and fall of globalisation: Why the world’s next economic order will differ. Retrieved from https://theconversation.com

- Forbes. (2025, July 4). Combined U.S. deficit with USMCA’s Mexico, Canada trade impacts. Retrieved from https://forbes.com

- Al Jazeera. (2025, October 23). US national debt surpasses a record $38 trillion. Retrieved from https://aljazeera.com

- Council on Foreign Relations (CFR). (2017, February 23). The U.S. national debt dilemma. Retrieved from https://cfr.org

- Liberty Street Economics. (2025, November 12). How has treasury market liquidity fared in 2025? Federal Reserve Bank of New York. Retrieved from https://libertystreeteconomics.newyorkfed.org

- Private Bank J.P. Morgan. (2025, November 6). A “monster?” A “time bomb?” How to see the real danger from U.S. debt. Retrieved from https://privatebank.jpmorgan.com

- Fortune. (2025, October 14). America is ‘going broke slowly’ says J.P. Morgan, as national debt soars. Retrieved from https://fortune.com